Teachers’ New NSSF Deduction Rates Starting February 2024. Teachers and other employees will be subject to new NSSF deduction rates from their pay stubs beginning in the month of February 2024. These rates range from Ksh. 420 to Ksh. 1,740.

According to information from an NSSF document, the sum that is now regarded as the lowest pensionable pay has increased from Ksh. 6,000 to Ksh. 7,000.

These employees will now be needed to give Ksh. 360, but from now on, they will be forced to contribute Ksh. 420, per NSSF.

The NSSF further states that individuals under the Upper Earnings Limit will now contribute Ksh. 29,000 instead of Ksh. 18,000, which means that most workers will pay a monthly fee of Ksh. 1,740 instead of Ksh. 1,080.

Teachers’ New NSSF Deduction Rates Starting February 2024

Keep in mind that, as in the past, the employer is obligated to match every contribution made by the employee.

Details indicate that the new rates will remain in place until the next review in January 2025.

It is expected that the new deduction plan, that which started last year will gradually see increase in rates over a five-year period.

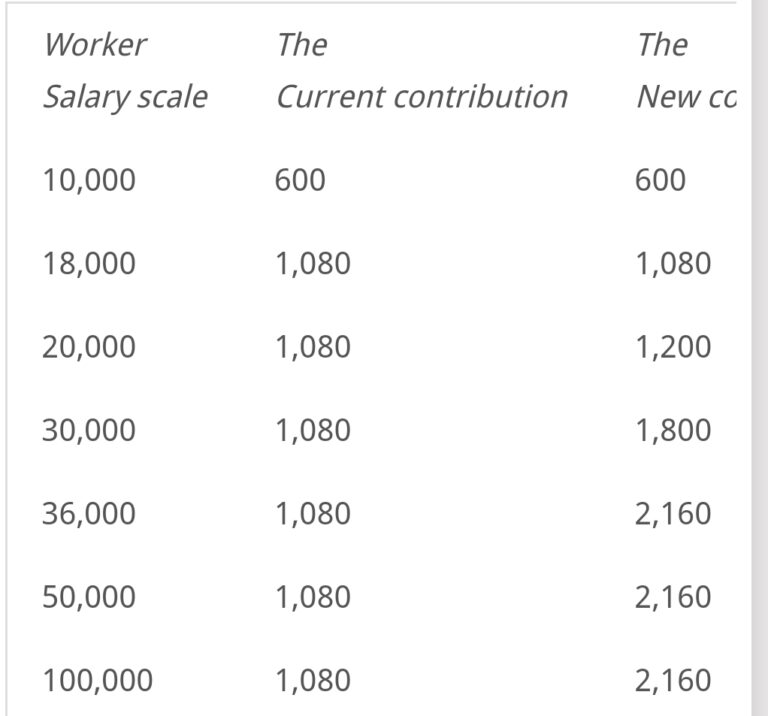

How New NSSF contributions will affect salary scales for different workers.

Worker Salary scale The Current contribution The New contribution

10,000 600 600

18,000 1,080 1,080

20,000 1,080 1,200

30,000 1,080 1,800

36,000 1,080 2,160

50,000 1,080 2,160

100,000 1,080 2,160

National Social Security Fund (NSSf) plays a key role of ensuring social protection to all workers In Kenya.

The body also ensures provision of social security to workers in the formal and informal sectors.

The body indicated all Employers, starting February 2024 payroll will see new NSSF Contribution deduction Rates for the Second Year as indicated here :

NSSF YEAR 2 CONTRIBUTION RATES, STARTING 2024

New salary deductions in accordance with the Third Schedule of the NSSF Act 2013

- The NSS Lower Limit [Tier 1] 7,000.00

- The Total Contribution by Employee 420.00

- The Total Contribution by Employer 420.00

- Total Tier 1 NSSF Contributions 840.00

- The Upper Limit [Tier 2] 36,000.00

- NSSF Contribution on Upper Limit which is 6% rate of upper Limit less Lower Limit 29,000.00

- Total Contribution by Employee 1,740.00

- Total Contribution by Employer 1,740.00

- The Total Tier 2 NSSF Contributions 3,480.00

- Total NSSF Contributions 4,320.00

In a notice, NSSF directed that the remittances to the Fund should be made by the 9th day of each subsequent month.

It further asked all the employers to reach out to the Fund for any clarification.