Retirement Policy Formulated By Treasury With Huge Benefits. The government has disclosed intentions to reassess the pension plan so that all workers can contribute to retirement home perks and cover medical expenses once they retire.

The National Treasury’s National Retirement Benefits Policy states that most workers have trouble finding housing and health insurance right once after leaving their jobs in order to retire.

Treasury has noted that a number of retirement programs have not allowed workers or individuals to save for the two crucial yet critical fundamental demands.

For retirees over 65, a major amount of their expenses are covered by retirement residences and health care when they retire.

The growing number of people over 65 is placing strain on the current, insufficient system for providing care for the elderly without adequate planning.

As mentioned by the policy paper, the situation worsens when the family support system breaks down.

Retirement Policy Formulated By Treasury With Huge Benefits

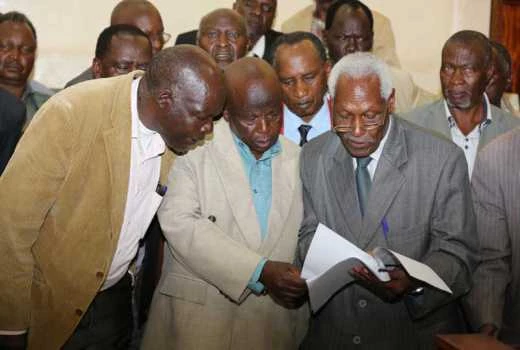

In an address to the media at his office, Treasury CS Prof. Njuguna Ndungu stated that in order to provide savings plans, it is reasonable for the government to amend current legislation to provide a legal framework for retirement programs.

The elderly and retirement homes should be included in this, most importantly, and measures that encourage employers and employees to contribute to Post-Retirement Medical Funds should be put in place.

People are currently saving for their retirement by deducting money from their paychecks each month. This will allow them to get a monthly stipend to help them fulfill their basic necessities after they retire.

One notable state-owned organization that presently offers retirement benefits is the National Social Security Fund (NSSF).

Simultaneously, the government is trying to set rules that will guarantee people should start receiving retirement benefits prior to turning 65.