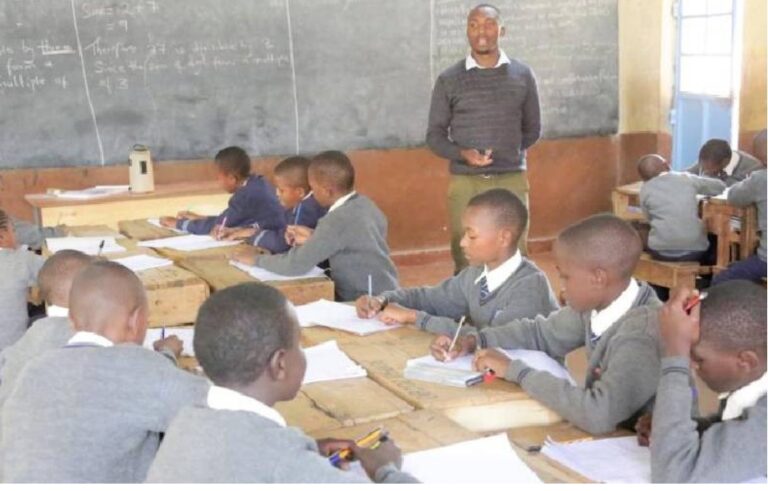

Beginning with December 2024 paystubs, Kenyans who are salaried, including as teachers and civil servants, will see a rise in their net wage.

This comes after the president signed a new tax law that will impact incomes starting in December 2024 and go into effect on December 27.

On December 13, Ruto signed the Tax Laws (Amendment) Act, 2024, into law, and it will take effect on December 27.

Employers have been instructed by the Kenya Revenue Authority (KRA) to comply with the new regulations, which will have an impact on salaries starting in December 2024.

In a circular KRA has outlined the major changes that employed Kenyans will be witnessing in their salaries beginning this month.

Teachers will get a salary increment of sh 380 to sh 4750 depending on ones job group.

The new changes may however delay December salaries which many employed Kenyans are waiting to use for the Christmas festival.

“Kenya Revenue Authority (KRA) informs employers and the public that pursuant to the Tax Laws (Amendment) Act, 2024 which comes into force on 27 December 2024 the following changes shall be applicable in the computation of PAYE for December 2024 and subsequent periods,” the notice read in part.

According to KRA, amounts deductible in determining the taxable employment income shall include amounts deducted as an Affordable Housing Levy, contribution to a post-retirement medical fund subject to a limit of Ksh15,000 per month, and contributions made to the Social Health Insurance Fund (SHIF).

It shall also include Mortgage interest, not exceeding Ksh360,000 per year that is Ksh30,000 per month, and contribution made to a registered pension or provident fund or a registered individual retirement fund up to a limit of Ksh360,000 per year that is Ksh30,000 per month.

Non-taxable gains and benefits from employment will not be subjected to income tax.

This includes the value of a benefit, advantage, or facility granted in respect of employment, where the aggregate value is less than Ksh60,000 per year or Ksh5,000 per month.

Meals provided by an employer on the value of Ksh60,000 per year or Ksh5,000 per month will also not be subjected to income tax.

Gratitude payments offered by the employer amounting to Ksh360,000 per year will also not be subjected to income tax. In most cases, gratitude payment is the payment made to the retirement pension scheme.

As Kenyans gear into 2025, these changes might lighten the financial load for many households, as it promises more money for them.